Key Facts: Premium Tax Credit

Updated August 2020

As a result of the Affordable Care Act (ACA), millions of Americans are eligible for a premium tax credit that helps them pay for health coverage. This Q&A explains who is eligible for the tax credit, how the amount of an individual or family’s credit is calculated, how mid-year changes in income and household size affect tax credit eligibility, and how the reconciliation between the tax credit amount a person receives and the amount for which he or she was eligible will be handled.

What is the premium tax credit?

The ACA created a federal tax credit that helps people purchase health insurance in health insurance marketplaces (also known as exchanges). The “premium tax credit” is available immediately upon enrollment in an insurance plan so that families can receive help when they need it rather than having to wait until they file taxes. People can choose to have payments of the premium tax credit go directly to insurers to pay a share of their monthly health insurance premiums charged or wait until they file taxes to claim them.

Who is eligible for a premium tax credit?

The premium tax credit is available to individuals and families with incomes between the federal poverty line and 400 percent of the federal poverty line[1] who purchase coverage in the health insurance marketplace in their state. A premium tax credit is also available to lawfully residing immigrants with incomes below the poverty line who are not eligible for Medicaid because of their immigration status.

To receive a premium tax credit, individuals must be U.S. citizens or lawfully present in the United States. They can’t receive a premium tax credit if they are eligible for other “minimum essential coverage,” which includes most other types of health insurance such as Medicare or Medicaid, or employer-sponsored coverage that is considered adequate and affordable.

In 2014, a Supreme Court decision gave states the choice whether to expand Medicaid to cover adults with incomes below 138 percent of the poverty line. As a result, individuals earning between 100 and 138 percent of poverty can qualify for a premium tax credit in states that do not expand Medicaid, if states don’t already cover those individuals.

What kind of marketplace health plan can someone buy with the credit?

People can use their premium tax credit to buy four different types of plans offered through the marketplace in their state: bronze, silver, gold, and platinum. All plans sold in the marketplace must meet standards to ensure they provide adequate coverage. However, the plans vary, with bronze plans providing the least comprehensive coverage and platinum plans the most comprehensive.

In general, bronze plans require the most overall “cost sharing,” which means costs like deductibles and co-pays. Platinum plans would have the least overall cost sharing. For example, a bronze plan will likely have a higher deductible than a silver plan, while a platinum plan will likely have a lower deductible than a silver plan. People can purchase any of the four types of plans. But, cost-sharing reductions (which are available to people with incomes up to 250 percent of the poverty line) that lower deductibles and the total out-of-pocket costs under the plan, are only available to people who purchase a silver plan. (For more information on cost-sharing reductions, see Key Facts: Cost-Sharing Reductions)

Marketplaces also display catastrophic plans that are less comprehensive than bronze plans, but they are only available to people under the age of 30 and those who receive a marketplace exemption due to hardship or lack of an affordable insurance option. A premium tax credit cannot be used to buy these plans.

How much help do people get?

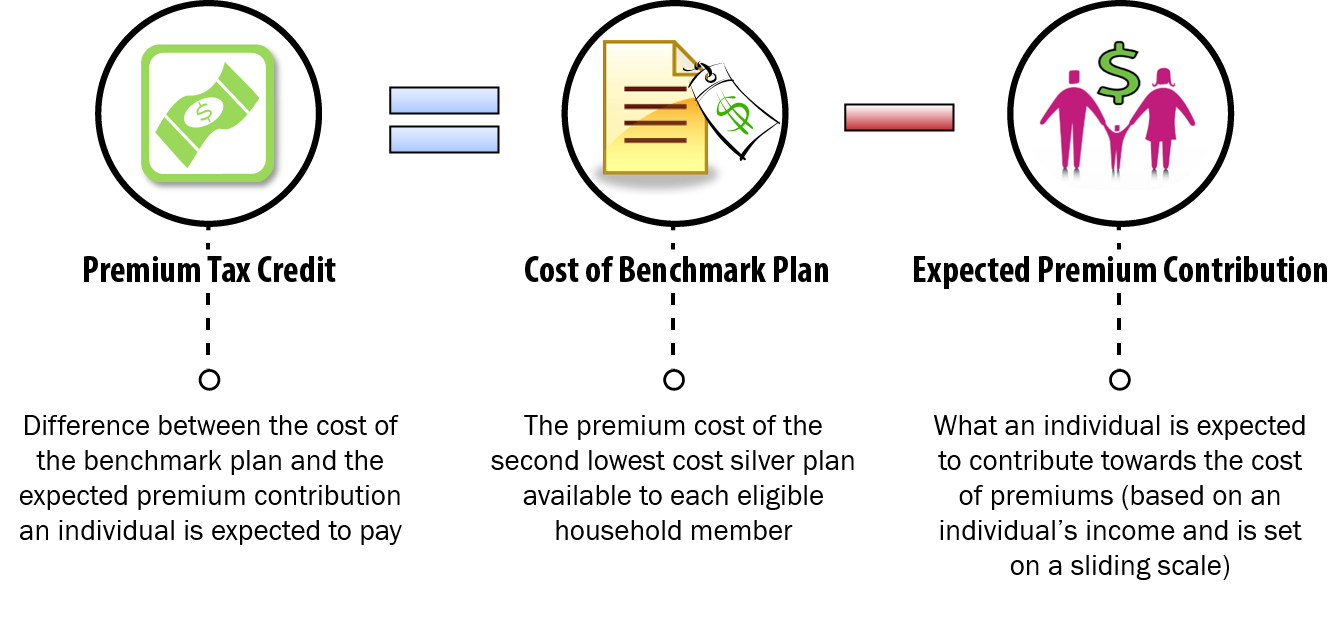

To calculate the premium tax credit, the marketplace will start by identifying the second-lowest cost silver plan that that is available to each member of the household, called the “benchmark plan.” The amount of the credit is equal to the total cost of the benchmark plan (or plans) that would cover the family minus the individual or family’s expected contribution for coverage (see Figure 1).

| FIGURE 1: Calculation of the Premium Tax Credit |

|

The individual or family is expected to contribute a share of their income toward the cost of coverage. That share is based on a sliding scale. Those who earn less have a smaller expected contribution than those who earn more, as shown in Table 1. For example:

- John is 24 years old and has an annual income of $25,520, which equals 200 percent of the poverty line. His expected contribution is 6.52 percent of his income, or $1,663 a year. The benchmark plan available to John is priced at $5,000; John would be eligible for a credit amount of $3,337 ($5,000 minus $1,663).

- Peter, Mary and their two children have an annual income of $65,500, which translates to 250 percent of the federal poverty line. At this income level, the family’s expected contribution is 8.33 percent of their income, or $5,456 a year. In the area where Peter and Mary live, the total premiums for the benchmark plan that would cover all members of the family is $15,000. The credit amount that the family would be eligible for is $9,544, which is $795 a month. ($15,000 minus their expected premium contribution of $5,456). An advance payment of $795 a month will be paid directly to the insurer offering the health plan that the family selects; the family would be responsible for paying the remaining premium to the insurer.

| TABLE 1: Expected Premium Contributions at Different Income Levels (2021) |

|||

| Income | Expected Premium Contribution Remaining After PTC | ||

| Percentage of poverty line | Annual dollar amount [1] | Premium contribution as % of income (in 2021)[2] | Monthly contribution |

| Family of four | |||

| < 133% | < $34,846 | 2.07% | varies |

| 133% | $34,846 | 3.10% | $90 |

| 138% | $36,156 | 3.41% | $103 |

| 150% | $39,300 | 4.14% | $135 |

| 200% | $52,400 | 6.52% | $285 |

| 250% | $65,500 | 8.33% | $455 |

| 300% | $78,600 | 9.83% | $644 |

| 400% | $104,800 | 9.83% | $858 |

| > 400% | > $104,800 | n/a | n/a |

| Individual | |||

| < 133% | < $16,970 | 2.07% | varies |

| 133% | $16,970 | 3.10% | $42 |

| 138% | $17,608 | 3.41% | $49 |

| 150% | $19,140 | 4.14% | $66 |

| 200% | $25,520 | 6.52% | $138 |

| 250% | $31,900 | 8.33% | $221 |

| 300% | $38,280 | 9.83% | $313 |

| 400% | $51,040 | 9.83% | $418 |

| > 400% | > $51,040 | n/a | n/a |

How does the marketplace determine the applicable benchmark plan?

The benchmark plan is the second lowest-cost silver plan that is available to each member of the household. In many cases, such as for single individuals or for parents and their dependent children, coverage can be obtained through a single policy. In cases where there may not be a silver plan offered through the marketplace that covers every single member of the household who is eligible for a premium credit (for example, because of the relationships of the individuals in the household), the benchmark may be based on the second lowest-cost silver option for the combined value of more than one policy.

The following example illustrates how the marketplace would determine the applicable benchmark plan in some different situations:

- Example 1: Single individual obtaining self-only coverage. John is eligible for a premium tax credit, with an expected contribution of 6.52 percent of his income, or $1,656 a year. The three lowest cost silver plans providing self-only coverage in John’s area are Plans A, B, and C, priced at $4,800, $5,000, and $5,200, respectively. Plan B, which is the second lowest cost silver plan, will be used as the benchmark.

- Example 2: Parents and two children obtaining family coverage. Peter, Mary, and their two children have income at 250 percent of the federal poverty line, qualifying them for a premium tax credit with an expected contribution of 8.33 percent of income, or $5,460. The benchmark plan in this case is the second lowest cost silver plan that covers the entire family. In the area where the family lives, the three lowest cost silver plans that cover the entire family are Plans A, B, and C, which cost $14,800, $15,000, and $15,200, respectively. Plan B, which is the second lowest cost silver plan, will be used as the benchmark.

- Example 3: Parents and two children obtaining coverage only for the parents. The circumstances are the same as in Example 2, except that the family now lives in a state that has a higher income eligibility level for CHIP coverage so that the two children are ineligible for a premium credit because they qualify for CHIP. Peter and Mary’s household income would be the same at 250 percent of the poverty line, and their expected annual contribution would stay at $5,460. The applicable benchmark in this case is the second lowest silver plan that covers just Peter and Mary. The three lowest cost silver plans that cover Peter and Mary are Plans A, B, and C, which cost $9,800, $10,000, and $10,200, respectively. Plan B, which is the second-lowest cost silver plan, will be used as the benchmark in calculating the premium tax credit amount.

- Example 4: Members of a tax household residing in different locations. The circumstances are the same as in Example 2, except that one child is attending college in a different part of the state where services are considered out of network and would not be covered by Peter and Mary’s plan. As a result, the family decides to purchase a separate plan where the child attends college and resides for most of the year. The three lowest cost silver plans that would cover Peter, Mary, and the younger child are Plans A, B, and C, which cost $12,300, $12,500, and $12,700, respectively. The three lowest cost silver plans that would cover the child in college are Plans D, E, and F, which cost $2,400, $2,500, and $2,600, respectively. In this case, the marketplace will add the premiums for Plans B and E to get the benchmark premium that will be used to calculate the premium credit amount for the family.

Does the premium tax credit account for differences in the price of plans based on age, location, and other factors?

The amount of the premium tax credit that an individual or family receives will take into account family size, geographic area, and age. For example, older people will get a larger premium credit than younger people, and an individual who lives in a high-cost state would receive a larger premium credit than an individual with the same characteristics who lives in a low-cost state. However, the premium tax credit will not cover the portion of the premium that is due to a tobacco surcharge. The following examples illustrate how age and tobacco use will affect the amount of the premium tax credit:

- John is 64 years old and has an annual income of $25,520, or 200 percent of the poverty line, which qualifies him for a premium tax credit. His expected contribution is 6.52 percent of his income, or $1,656 a year. Because he is 64 years old, John’s premium could be as much as three times the cost of the premium for someone who is 24 years old. Assuming John’s premium is $15,000, his expected contribution would still be $1,656 a year, the same as the expected contribution for a 24-year old, and his premium credit would be much larger, $13,344 in this example ($15,000 minus $1,656).

- As in our original example, John is 24 years old. As a non-smoker, the benchmark plan available to John is priced at $5,000 so John would be eligible for a credit amount of $3,344 ($5,000 minus $1,656). If John was a smoker, however, in most states insurers could charge him as much as one and a half times the usual premium. This would raise the cost of the second lowest cost silver plan to $7,500. However, John’s premium credit amount would not be adjusted to account for the additional $2,500 in premiums he would be charged because he is a tobacco user. As a result, even with a premium tax credit, it would cost him an additional $2,500 to purchase the benchmark plan.

Do people who receive a premium tax credit ever have to pay more than their expected contribution?

How much people will have to pay for coverage depends on the plan they choose. People can use the premium tax credit to buy a bronze, silver, gold, or platinum plan. The amount of the credit generally stays the same, regardless of which plan a person selects.

Gold and platinum plans will have higher premiums than the silver benchmark plan used to calculate the premium tax credit amount, so people will have to pay more than their expected contribution towards the premiums for these plans.

Bronze plans usually cost less than the benchmark plan. So, if an individual or family chooses a bronze plan, their share of the premium will be lower and possibly even zero. (The premium tax credit cannot exceed the plan premium,)

People must purchase a silver plan in order to get help with their cost-sharing expenses. So, purchasing a bronze plan may not be the lowest-cost option for an individual or family when all their out-of-pocket health care costs are considered.

Here’s how it would work, using the earlier example of John, a single individual:

- John is 24 years old and his annual income is equal to 200 percent of the poverty line. In 2021, based on the cost of the benchmark plan and his expected contribution, he is eligible for a credit amount of $3,344 for the year. The benchmark plan for John costs $5,000 per year. There is also a bronze plan available that would cost $3,300 per year and the lowest-cost silver plan that would cost $4,500.

- If John purchases the benchmark plan, he will have to contribute $1,656 for the year (the $5,000 premium minus the $3,344 premium credit), but he will also be eligible for the cost-sharing reductions that will lower how much he will pay in deductibles and other out-of-pocket costs. If John purchases the cheapest silver plan which costs $4,500 a year, his contribution would go down to $1,156 for the year.

- If John purchases the bronze plan that costs $3,300 a year, he would not have to pay any premiums because the premium tax credit would cover the cost of the entire premium. (Even though John is eligible for a credit of $3,344, he could only claim a credit of $3,300, the bronze plan premium.) He would not be able to receive cost-sharing reductions. This means that while John’s share of the premium will be zero under the bronze plan, he will have larger deductibles and co-payments when he needs health care services. His overall out-of-pocket health care costs (premiums and cost-sharing charges) could end up being higher under the bronze plan than under the silver plan, depending on how much health care he uses.

How do people qualify for the premium tax credit?

People can apply through the Health Insurance Marketplace online, by mail, or in person. (The open enrollment period for coverage in 2021 is November 1, 2020 through December 15, 2020, and some states with State-Based Marketplaces have longer open enrollment periods.) Applicants need to provide information on their income, the people in their household, how they file their taxes, and whether they have an offer of health coverage through their job. Based on the information provided in the application, the marketplace determines whether members of the household are eligible for a premium tax credit or other health care programs like Medicaid and the Children’s Health Insurance Program (CHIP).

Do people need to wait until they file taxes to receive the premium tax credit?

No. People can choose to receive the credit in advance. Many people wouldn’t be able to afford the entire premium upfront and wait until they file taxes to get reimbursed. Getting the premium tax credit in advance allows them to pay their monthly insurance premiums and enroll in coverage purchased through the marketplace. This is how it works:

- John is eligible for a premium tax credit of $3,344 a year. During the open enrollment period, he chose to purchase the second-lowest cost silver plan (the benchmark plan), which has an annual cost of $5,000. He decided to take the premium tax credit in advance, which means that the IRS sends a monthly payment of $279 ($3,344 divided by 12) directly to his health insurer. This brings down John’s portion of the health insurance premium from $417 to $138 per month, which he pays the insurer.

People who receive advance payments of the premium tax credit will need to file taxes for the year in which they receive them. For example, someone who received advance payments of the credit for the 2020 calendar year will need to file a tax return and reconcile their APTC for 2020 before the April 2021 deadline.

Also, married couples who receive advance payments will need to file a joint return to qualify for the premium tax credit. There is an exception to this rule for survivors of domestic violence and individuals who have been abandoned by their spouses. In addition, an individual who is married but who qualifies to file taxes as Head of Household can also qualify for a premium tax credit.

A person who files taxes as Married Filing Separately cannot claim a premium tax credit unless they fall under one of two exceptions:

- Survivors of domestic violence: An individual who lives apart from his or her spouse and is unable or unwilling to file a joint tax return due to domestic violence will be deemed to satisfy the joint filing requirement by making an attestation on the tax return. Under this IRS rule, taxpayers may qualify for a premium tax credit despite having the tax filing requirement of married filing separately.

- Abandoned spouses: A taxpayer is still eligible for a premium tax credit if he or she has been abandoned by a spouse and certifies on the tax return that they are unable to locate the spouse after “reasonable diligence.”

These exceptions can be claimed for no more than three consecutive years.

What if someone has not filed a tax return in the past?

People who did not file a tax return in prior years can still qualify for a premium tax credit if they are otherwise eligible, but they will have to file a return for years they receive advance payments of the premium tax credit to qualify in future years.

Do people have to take the premium tax credit in advance?

No. Most people want to get the credit in advance because they can’t pay their entire monthly health insurance premiums without help, but if they choose, people can wait and receive the credit when they file their taxes.

People can also take a lower advance payment than the amount that is calculated based on their estimated income for the year and receive any remaining credit they are due at tax time.

What happens when people who get a credit in advance file their taxes?

The amount of the advance premium tax credit that people receive is based on a projection of the income the household expects for the year. The final amount of the credit is based on their actual income as reported on the tax return for the year the advance payment was received.

People who receive advance payments of the credit will have to reconcile the amount they received based on their estimated income with the amount that is determined based on their actual income as reported on their tax return. This means that people whose income for the year is higher than they previously estimated could have to pay back some or even all of the advance payments they received. On the other hand, people whose income ends up lower than estimated could get a refund when they file their taxes. For example:

- Peter, Mary, and their two children estimate that their 2021 income will be $56,475. The marketplace determines that they are eligible for a premium tax credit of $10,793 for the year. Peter and Mary decide to take the credit in advance, and the money is sent directly to the insurer. When Peter and Mary file their 2020 taxes in February 2021, it turns out that their income was a little bit higher than they estimated because Peter received a $2,000 bonus at the end of the year. The family’s final credit amount is $296 less than the advance payments they received — $10,497 instead of $10,793. This means that at tax time, if the family was due to receive a refund, the refund would be reduced by $296. If they were not getting a refund, they would have to pay $296 to the IRS.

- On the other hand, if Peter and Mary’s actual income for 2020 was $2,000 lower than they estimated, their final credit amount would be $11,100. This means the family received $307 less in advance payments than they were eligible for. At tax time, the family would either receive an additional $307 refund, or if they owed taxes, the amount they owe would be reduced by $307.

One special rule is that if the advance payments received by people are greater than the final credit amount for which they are eligible, their repayment will be capped if their income is less than 400 percent of the poverty level. Table 2 shows the repayment limits. Note that if income for the year exceeds 400 percent of the poverty line, the individual or family would have to repay the entire amount of the advance payments they received.

| TABLE 2: Cap on the Amount of Advance Credits That Individuals and Families Must Pay Back (tax year 2020)[2] |

||

| Income as % of poverty line | Single taxpayers | Other taxpayers |

| Under 200% | $325 | $650 |

| At least 200% but less than 300% | $800 | $1,600 |

| At least 300% but less than 400% | $1,350 | $2,700 |

| 400% and above | Full amount | Full amount |

What happens if people’s income or circumstances change during the year? How does that affect their eligibility for a premium tax credit?

People who experience changes in income and household size over the course of the year should report these changes to the marketplace when they happen because those changes can affect the amount of their premium tax credit. People whose incomes go down may be able to get a higher advance payment of the premium tax credit for the rest of the year, which would lower their monthly premium payments. (They also may receive more help with their cost sharing.) People whose incomes increase should report the change to have their credit for the rest of the year lowered and avoid having to pay back excess advance payments when they file their taxes. Household changes, which affect family income as a percent of the federal poverty level, such as having a baby or having a child leave the home, will also affect the amount of the credit and should be reported.

Another way people with fluctuating or unpredictable income can avoid having to pay back advance payments at tax time is to take less than the amount calculated based on their estimated income.

People who receive advance payments of the premium tax credit and who, partway through the year, receive an offer of employer coverage that is considered affordable and adequate should also report this change to the health insurance marketplace, as should those who become eligible for other coverage, such as Medicare or Medicaid. Having other “minimum essential coverage” would make people ineligible for a premium credit for the rest of the year.

Can people who don’t have to pay federal income taxes take advantage of the premium tax credit?

Yes. The premium tax credit is refundable, so people whose income taxes are lower than their premium tax credit can still take advantage of the credit. People eligible for the credit will be entitled to the full credit amount whether they take it in advance or wait until they file their taxes. For example:

- With an annual income of $24,280 for 2020, John is eligible for a premium tax credit of $3,412 for the year. John enrolls in a silver plan. In February 2021, when John files his 2020 tax return, John’s federal tax is $1,500. He will receive the full premium tax credit amount of $3,412 even though the amount of the credit is larger than his federal income tax liability.

[1] The marketplace uses the federal poverty guidelines available during open enrollment to determine premium tax credit amounts for the following year (e.g. 2020 guidelines for 2021 coverage).

[2] These percentages are indexed and will change each enrollment year. For yearly guidelines, see Reference Chart: Yearly Guidelines and Thresholds.